Interest Rates and the GR Model

June 3, 2018 13 minutes • 2586 words

Table of contents

Why are interest rates so important in Neoclassical Economics, but not so important in Classical Economics?

Interest rates became part of national policy because of John Maynard Keynes, one of the pillars of modern economics. The US suffered from a Depression in the 1930s because the profit maximization doctrine, first espoused by the Marginal Revolution in the 1870’s, prevented the spending and investments that would have revived the economy according to the principles of Classical Economics.

Instead of denouncing profit maximization, Keynes actually embraced it as the speculative (gambling) motive through the following reasoning:

- Life is determined by resources

- Resources are determined by work and employment

- Employment is determined by investment

- Investment is determined by the interest rate

- Interest rate is determined by liquidity preference

- Liquidity preference is determined by transactional motive and speculative motive

- These motives are determined by expectation

- Government policy on interest and public spending can affect this expectation and make people spend money in order to make an economy rise from the crash

To support this logic, he created the marginal efficiency of capital curve which is the ratio between an investment’s cost and its future revenue. The investment’s cost is then determined by the interest rate.

In the classical system, however, entrepreneurs and investors won’t be too fussy about this. They would focus instead on getting that investment up and running ahead of the other guy.

| _ | Classical Economics | Neoclassical Economics |

|---|---|---|

| Motive | Production | Profit Maximization |

| Important people | entrepreneurs and industrialists | banks and financers |

By focusing on cash and interest rates instead of actual factories or production, the Neoclassical System gives so much attention to the banking industry. The problem is that finance is actually unproductive labor !

Banks and financiers do not create goods or commodities. They merely circulate the fund that will be used by workers and producers. This is opposite of the Classical System that focused on the workers and producers.

The Mistakes of Keynes

The influence of profit and money makes its way in Keynes’ definition of interest rate as the reward for letting go of cash:

This leads to his mistake in asserting that interest rates can never be negative:

The existence of negative interest rates is proof that Keynes is wrong and therefore his defintion is wrong.

Supereconomic Interest

According to Adam Smith, interest is the revenue from lending something to someone.

- If I lend you my pen with half an amount of ink and you return it with zero ink, then I would have lost utility in lending it to you. This would make me stop lending pens

- If you give it back with full ink, then I would have gained 100% utility from lending it to you. This would then encourge me to lend you pens in the future

From here, we can create our real-world interest rates:

| Interest rate | 100% | 0-10% | -100% |

|---|---|---|---|

| Loan Terms | You can borrow my half-ink pen. But return it with full ink | You can borrow it, but must return it with the same 50% ink or a bit more | You can return the pen with no ink |

| Effect | No one would borrow the pen. They would instead buy their own | This is normal and fair | This is unfair to the lender, but happens sometimes. |

As you can see, the negative interest rates for pens and even negative pen prices are possible. This is matched by the negative interest rates of money and the negative prices of oil – things that were thought impossible in the past.

From the lender’s perspective, the interest rate is merely the cost of lending. But from society’s perspective, the interest indicates three things:

| Indicator | Explanation |

|---|---|

| 1 - The demand for pens | The fact that interest rates were formalized means that the pen-lending has become regular |

| 2 - The credit-worthiness (quality) and use-volume (quantity) of the pen-users | From the lender’s perspective, the existence of a lot scammer pen-borrowers will prompt him to charge a high interest on his ink in order to reduce the demand, and let the revenue make up for the ink lost to scammers. In the absence of scammers, a high interest rate means that there is too much demand for pen-borrowing which then shows a lot of pen-activity. The high rate discourages the non-serious demand for pens. |

| 3 - The availability of pen-lenders | From the borrower’s pespective, a high interest rate shows that the pen-owner can charge whatever he wants. In this sense, it is a sign of having too few pen-lenders. |

We can then substitute money for pens, so that a high interest rate for money could indicate:

| Indicator | Explanation |

|---|---|

| A high demand for money | A rapid economy will need more money and therefore increase interest rates. |

| Low credit-worthiness (quality) of borrowers | The high demand increases the number of borrowers and decreases their overall quality. This naturally leads to bust. |

| Few banks or banks that are too consolidated | Generally, the competition between banks will reduce the interest rate. |

GR Model: Is Society Credit-worthy or Speculative?

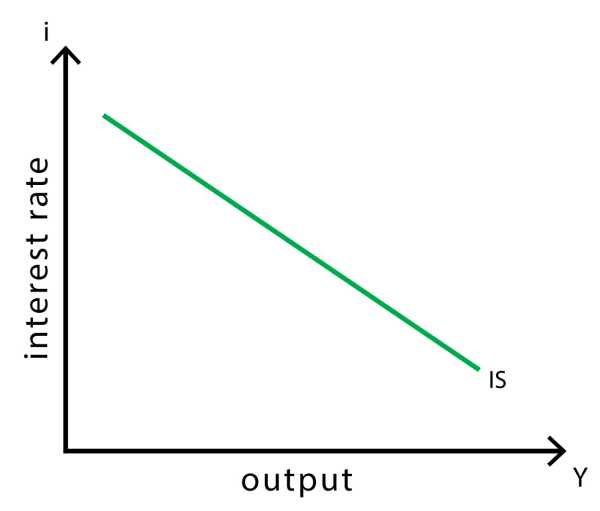

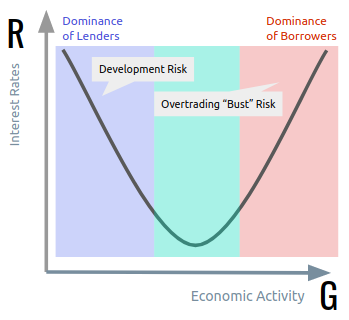

From the nature of lending and interest in society, we can expand Keynes’ IS curve below to have an upward slope which we call the GR model where G stands for economic growth and R is the interest rate:

- In a poor society, the lender’s risk is in the poor borrowers not being able to use the money productively. But if they do and the lending succeeds, then the revenue generated can increase the productivity of the poor society by a lot

- In a wealthy sociey however, the lender’s risk is in having too many rich borrowers trying to use money even if productivity has been maxed out. Their failure to use the money properly thencreates the usual bust after every boom

From this U-shaped curve, we have a bigger perspective which we can base our definition of interest rates on:

Having clear defintions is important because our goal is to automate the economy to prevent poverty and inequality.

| Word | Meaning |

|---|---|

| Demand | Resource-demand of the borrowers |

| Credit-worthiness of the borrowers | The productive use of whatever is lent, as to be able to return it |

| Availability of lenders | The savings or pool of resources |

The robustness of our definition makes it applicable even to non-monetary items. For example, the interest rate in car-lending is the revenue in lending cars that is determined by the demand and credit-worthiness of the car-borrowers and the availability of the car-lenders. In this way, the interest of car-lending can be paid for in spare parts, gasoline, upgrades, or the usual cash.

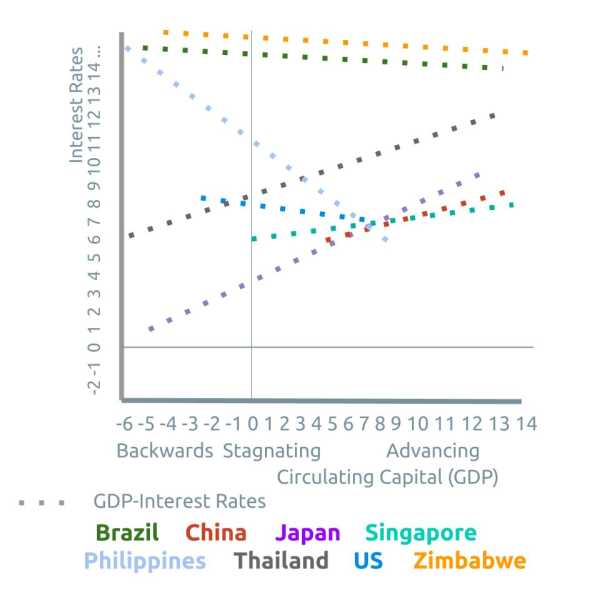

We can then implement the GR model by using GDP as G so that we can determine whether the lenders or the borrowers have more economic power in a society.

- A downward sloping line would mean more power to the lenders

- An upward sloping one means the borrowers have more power.

This chart shows that in the US, Brazil, Philippines, and Zimbabwe, the banks, both public and private, have more power. This is proven by:

- The 2008 Financial Crisis caused by US banks

- The huge debt of Brazil and the Philippines caused by their governments spending to drive growth

- Zimbabwe’s hyperinflation caused by the dictator Mugabe

The situation is slightly different for Singapore and China where there is more balance. However, the case of Japan and Thailand shows a dominance of borrowers and is proven by two phenomena:

- The 1997 Asian Financial Crisis and the prevalence of hot money in Thailand

- Japan’s Lost Decade began with its asset price bubble in 1991, signifying strength in borrowing. This matches our own conclusion that the cause of the failure of Abenomics is in corporate Japan* having too much strength over their banks .

Thus, a financial crisis can be caused by either the lenders or the borrowers. We cannot say that lending should be done by the government or by too-big-to-fail banks, nor can we say that banks should always make borrowers happy by liberalizing lending and flooding them with cheap money.

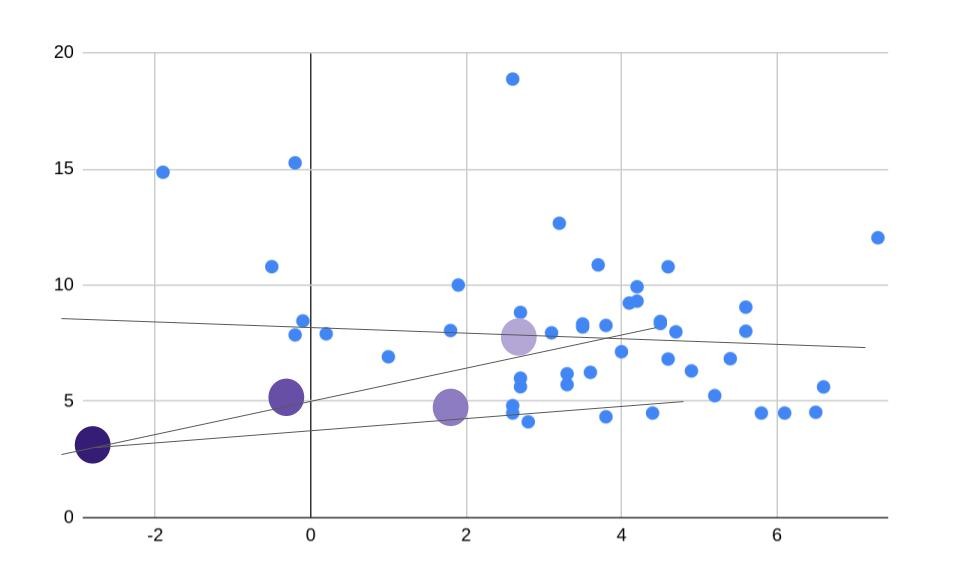

Since the GR model uses historical data, we can use it, in theory, to predict what interest rates are needed to create a certain GDP level. In the example below, it predicts that an interest of around 4.2% will lead to a 2% growth. In reality, the rate was 3.25% leading to a growth of 2.5%. Of course, this can be refined with more data.

Dialectical Forensic Analysis: The Love of Money Leading to the Dominance of Profit-Earners

Why did Keynes specify cash instead of money in his definition of interest rates?

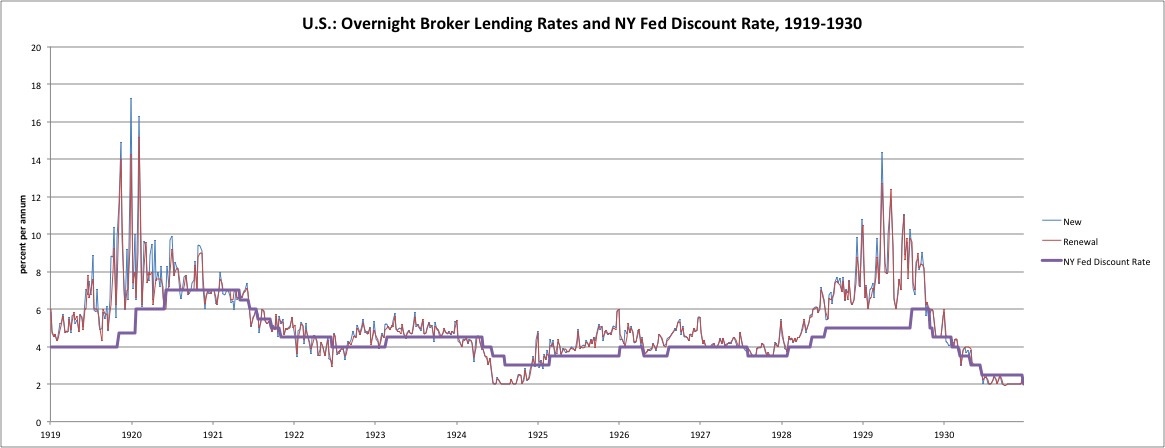

This is because the boom of the 1920s was itself caused by the liquidity afforded by paper-based bank notes coming from the establishment of the Federal Reserve. Once a mind has experienced pleasures, it does not want to part with them.

That pleasurable boom was caused by cash and so it became Keynes’ interest to enshrine cash and denounce gold, which is obviously harder to circulate than paper. But this difficulty in circulation is exactly what gives gold its stability.

Keynes falls hook, line, and sinker for the mercantilist doctrine that money is wealth:

Money..frequently signifies wealth, and this ambiguity of expression has rendered this popular notion so familiar to us that even they who are convinced of its absurdity are very apt to.. take it for granted as an.. undeniable truth. Some of the best English writers upon commerce set out with observing that the wealth of a country consists, not in its gold and silver only, but in its lands, houses, and consumable goods..

In the course of their reasonings, however, the lands, houses, and consumable goods seem to slip out of their memory, and.. their argument frequently supposes that all wealth consists in gold and silver, and that to multiply those metals is the great object of national industry and commerce.

The love of money causes the marginalists to teach the doctrine of profit maximization to all, eventually leading to the 1929 Crash. They then blame Classical Economics for the problem created by Marginalism, which they propose to solve by pumping even more money to feed the animal spirits of speculators, investors, and businessmen who are already programmed to do profit maximization.

- Open market operations and negative interest rates (QE) fill the financial industry with money

- “Deficit spending” and “bailouts” by governments fill corporations with money in the hopes for a “multiplier effect”

These two solutions benefit banks and corporations at the cost of public debt which must be paid by income taxes and sales taxes from wage earners. These solve stagnation and recession by energizing the former and dragging the latter to go with them. This is similar to a Roman empire slave master driving growth by driving his slaves to work more.

This inequality manifests as:

- The gigantic growth of financial assets via wholesale money to enrich the financial industry. This causes:

- huge debts that lead to deficient government services and political instability:

- the Communist revolution in South America in the 60s-70s was caused by the Latin american debt crisis

- the Asian Crisis of 1997 caused the instability in Asia

- the 2008 Financial Crisis caused the Eurozone Crisis and Arab Spring

- price inflation of assets such as stocks and real estate that further fuels inequality

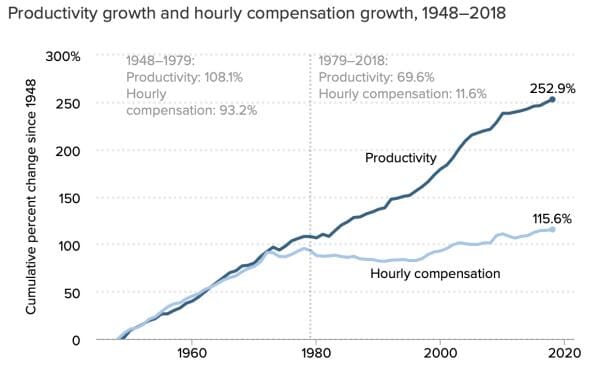

- The sucking of productivity from the working class through the 2% inflation target to enrich the investors and corporations via retail money. This causes:

- the productivity-wage gap

- bullshit jobs

- the need for two or more jobs to meet inflation

- reduced competitiveness of the economy

The Giant Bag of Finance

Keynes’ biggest error regarding interest is that his definition does not include credit worthiness.

This causes central banks to pump money into commercial banks * without bothering to know whether there are credit-worthy people to receive that money in the first place.

This uncertainty:

- prevents the money from actually going into employment, wages, and inclusive growth.

- increases government debt as it floods banks with money that finds no use and merely goes around to increase asset prices.

It would be like a factory churning out wholesale products that never reach the end consumers. Instead, those products flood the warehouses for the benefit of the warehousing industry. The factory is the central bank, while the warehousing industry is the financial industry.

Profit maximization then is like a gigantic money-bag that stores all the fiat from monetary easing that cannot find high profits in the real world. The mergers and acquisitions in the ’90s made this finance-bag even bigger. It no longer becomes interested in funding small profit opportunities. Instead, it just finances big deals.

This giant finance-bag* then matches:

- the giant crises that have happened and

- the giant debt-bag of governments that really must be paid by the people.

*The Nixon Shock created fiat which then gave power to commercial banking and then to development and investment banking, which are merely two sides of the same wealth-coin. This explains why they were very dominant from the ’70s to the late ’90s until their demise in the 1997 Asian Crisis and 2008 Financial Crisis.

The Solutions

Marginalism created two problems, one for wholesale money and another for retail money. This is why Supereconomics has two major solutions:

- A modified version of Pool Clearing from EF Schumacher which uses Clearing Funds to replace the finance-moneybag.

The money in Clearing Funds go directly to manufacturers, producers, and service providers. Its interest rates are determined by the GR model.

- Zero inflation target that is achievable through barter and barter-credits.

Barter-credits are pegged to the value of grains which are not subject to interest rates.

Other minor solutions are:

- replacing the profit maximization doctrine of Marginalism with the Effort Theory of Value

- a machine learning system called ISAIAH to guesstimate the credit-worthiness of people.