The Demand, Capital, Industry, and Trade Tool (DCIT)

Table of Contents

According to Adam Smith, a crisis begins when a country’s industry does not match its capital. This is similar to an inexperienced entrepreneur launching a business out of sheer speculation.

- The 2008 Financial crisis was caused by securitization unnaturally increasing industry on paper

- The Asian Financial Crisis was caused by hot money unnaturally increasing industry in Asia. This led to non-performing loans

- Black Wednesday in 1992 was caused by John Major overvaluing the pound to promote a rosy British industry. This false picture was attacked by George Soros

- The 1929 Crash was caused by stock traders who overvalued stocks

- The Mississippi Scheme was caused by John Law overvaluing the economic potential of Louisiana

The general industry of society can never exceed what the capital of the society can employ.. the number that can be employed by a society must be proportional to the total capital of that society. No commercial regulation can increase industry beyond what its capital can maintain. It can only divert some of it into a direction which it might not otherwise have gone into. It is uncertain whether this artificial direction will be more advantageous than its natural direction.

Adam Smith

The Wealth of Nations Simplified, Book 4

Supereconomics has three tools* to check the health of an economy:

- Purchasing Power or NDP - this checks the First and Second Laws of Value

- Economic Table - this checks the Third and Fourth Laws of Value

- DCTI - this checks the four laws through time

*The Economic Table and DCTI are too time-consuming to do manually, so we just visualize it through an app. NDP, on the other hand, can be done with pen and paper.

| Measure | General | Specific |

|---|---|---|

| Quantity of Real Value | GDP + Industry + Trade |

Purchasing Power |

| Quality of Real Value | GDP + Demand + Capital |

Economic Table |

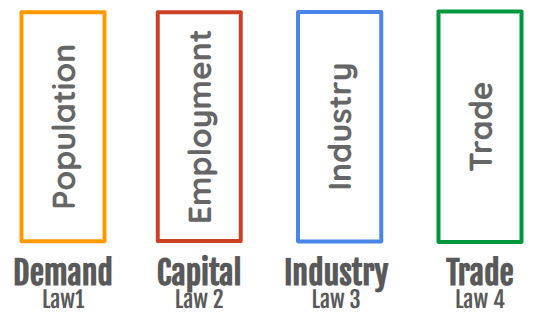

The DCIT Tool

The DCIT Tool can prevent crises by checking a society’s Demand, Supply, Trade, and Industry metrics to see if they match the Four Laws of Value :

These 4 factors manifest as economic indicators.

| Factor | Description | Law |

|---|---|---|

| Demand | The needs and wants of individuals or groups of individuals | 1st Law |

| Capital | Anything used to produce valuable goods or services | 2nd Law |

| Industry | The production of valuable goods or services, from capital | 3rd Law |

| Trade | The exchange of goods or services done freely | 4th Law |

A tree that produces fruits is not considered economic activity until a human harvests the fruit for trading with other people.

A person who produces vandalism of no societal value will not be considered performing economic activity. But a person who paints a wall nicely (industry) using his own skills (capital) may be considered doing an economic service worthy of being paid (trade through employment).

Each unit of value must be traded in order to satisfy the needs and wants of a population.

The journey from demand to value-creation to satisfaction and/or recapitalization constitutes one iteration of an economic process comprising many small economic activities.

| Factor | Examples | |

|---|---|---|

| Demand | Population, Tourist Arrivals | |

| Capital | Capital Formation, PISA scores, University Rankings | |

| Industry | GDP, Industrial Production, Remittances | |

| Trade | Money Supply, Balance of Trade |

An imbalance of these 4 factors will lead to some kind of economic crisis.

| Factor | Too high | Too low |

|---|---|---|

| Demand | Overpopulation | Population Decline |

| Capital | Overinvestment | Underinvestment |

| Industry | Overproduction | Underproduction |

| Trade | Inflation | Bottlnecks, Trade wars |