How Multilateral Pool Clearing Can Solve Currency Crises and Bilaterialism

Table of Contents

Superphysics Note

There are advantages in settling international payments for goods and services by through Clearing.

-

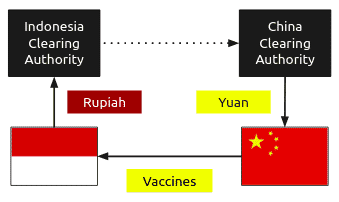

The importer in

Country Apays for the goods that he buys fromCountry Bby handing over a sum ofA-moneyto theCountry A Clearing Authorityin his own country to discharge his debt -

The exporter in

Country Breceives from theCountry B Clearing Authorityin his country an equivalent sum ofB-moneyto satisfy his claim.

This clearing can settle payments for:

- goods and services,

- patents and copyrights,

- dividend,

- interest and amortisation payments.

These “bilateral clearings” tend to equalise the trade between the two countries by:

- stimulating the exports of the export-deficient country, or

- curtailing the exports of the export-surplus country.

A strict bilateral trading system has disadvantages.

It would be better to have a multilateral trade where no country would need to balance its trade with any one country. It would be free:

- to buy from countries which are not its customers and

- to sell even to countries from which it does not buy.

Can we have multilateral clearing?

Assume that there are only 3 countries:

| Country | Status | Notes |

|---|---|---|

| USA | surplus country | sells more than she buys |

| Britain | balanced country | sells as much as she buys |

| Poland | deficit country | buys more than she sells |

Multilateral clearing implies that Britain should have no balance or remaining obligations. But Britain is released from these obligations only if the Americans are prepared to exchange their GBP-balances for Britain’s PLN-balances.

Why should they be prepared to do this?

I assume that GBP-balances are preferable to PLN-balances because Britain has achieved “balance” in trade, while Poland is a deficit country.

Why should the Americans exchange a better currency for a worse one?

If they can be made to do so, then we can have multilateral clearing.

Multilateral clearing exists in Europe. Germany forces the surplus countries to agree to the necessary exchanges of uncleared balances so that:

- the countries which have achieved balance are relieved of all claims and liabilities from the bilateral clearings, and

- the surplus countries simply remain as the creditors of the deficit countries.

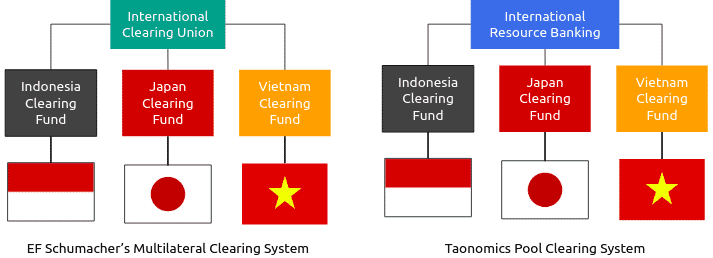

** Multilateral Clearing be achieved without the application of force, through “Pool Clearing”:**

- Every country sets up a National Clearing Fund*

- They agree on the exchange rates by which each currency is to be related to all other currencies

- Importers pay into their own National Clearing Fund using their own currency

- The exporter’s Clearing Fund is informed that payment has been received and pays the exporter

- Each Clearing Fund thus receives and disburses only national currency. It receives such currency from the home importers and disburses it to the home exporters.

*Schumacher Footnote: This paragraph merely states the theoretical principle of Pool Clearing. In practice, the channeling of all payments through the Clearing Fund can be made hardly noticeable to any individual trader. The established banks would be authorised to make and accept payments against documentary evidence and would merely settle the uncleared balance with the Clearing Fund. They would also continue to finance home importers and exporters in much the same way as before. Whether or not certain categories of in-payments or out-payments are to be made subject to special permit, is a question which every government has by itself. Any foreign exchange control is equally compatible with Pool Clearing.

Assume this goes on for 12 months and each Fund has 3 outcomes:

- Deficit countries will have excess local currency from importers, which will be spent buying Tbills*

- Surplus countries will be short of local currency for exporters and will sell Tbills to get cash

- Balanced countries will be in same position as 12 months before

Superphysics Note

What would be the position of ownership of the deficit countries?

- America sells 10x more to Britain

- Britain sells 10x more to Poland. Britain having achieved balance is no longer concerned. Her Fund has received an extra 10x from importers and disbursed an extra 10x to exporters

It follows that America owns a balance of 10x in Poland. A GBP-balance, which the Americans could own, simply does not exist. Thus, the surplus country owns the cash balance in the Clearing Fund of the deficit country.

But what if there are more than three countries?

- America sells 10x more to Britain

- Britain sells 8x more to Poland and 4x more to Holland

- America has a surplus of 10x

- Britain a surplus of 2x

- Cash balances of 8x and 4x are held in the Funds of Poland and Holland respectively.

They belong to whom? What proportion of the zloty-balances and of the guilder-balances belongs to America and what to Britain?

This cannot be answered unless the time sequence of all individual transactions were meticulously studied

- The balances in the deficit countries have lost their identity.

- The innumerable threads of business cannot be disentangled*.

- 83% of the total of balances in Poland and Holland belong to America

- 16% belong to Britain.

This is the decisive feature of “Pool Clearing”.

Superphysics Note

The Pooling of Local Currency and the International Clearing Union

The pooling of balances arises automatically out of the system’s mechanism. No surplus country is ever called on to exchange one balance for another.

Under bilateral clearings, America—in our example—would possess the GBP-balances even if Britain had achieved balance or even if Britain were a surplus country.

To multilateralise such a system, America would have to be forced against her immediate interest to swap her GBP balances against Britain’s balances in the deficit countries. There would be no country strong enough to enforce such swapping on a worldwide scale.

Under Pool Clearing, this whole question never comes up.

Any such cash balances in the various Funds are always the result of a deficit in the total trade of the countries in question. Mere bilateral trade deficits do not create the appearance of uncleared balances, unless they represent at the same time deficits in total trade.

Thus, the pooling of balances arises automatically.

But we still need to create some international machinery to give to this process a legal form. An “International Clearing Office” can be set up as Trustee in the pooling of uncleared balances*.

All cash balances accumulating (in the form of a holding of Treasury Bills) in the Clearing Funds of the deficit countries are to be taken over by the International Clearing Office. The Clearing Funds of the surplus countries will own each a share in the Pool, equal to the size of their respective surpluses.