Why Quantitative Easing Failed

Japan launched Quantitative Easing (QE) as part of Abenomics which was announced in 2012, just as the US launched theirs after the 2008 Financial Crisis. Both actions failed to drive economic growth for both countries and merely resulted in additional public debt.

To explain why QE was used and why it failed, we need to go back to 1913.

Open Market Operations

In that year, the Federal Reserve (Fed) was established in the US to provide stability after the Panic of 1907. By the early 1920’s, it had overstepped this function and had gone into open market operations and allowed banks to rediscount loans.

From providing stability, the Fed went for promoting growth–this is the first subtle mistake.

The job of growing the economy is done by commercial banking as the “retailer” of money. It is not done by central banking or the “wholesaler” of money.*

Superphysics Note

The circulation of every country is divided into 2 branches:

- The circulation of the dealers with one another

- The circulation between the dealers and the consumers

Adam Smith

Wealth of Nations Book 2 Chapter 2

Such operations filled the economy with “wholesale” money which then led to the second mistake – commercial banks enabling buying on margin. This filled the economy with “retail” money which fueled speculation, finally leading to the 1929 Crash.

Thus, it took 2 ingredients to cook up a money-crisis:

- The mistake of the central bank pumping wholesale money

- The mistake of the commercial and investment banking system using that wholesale money through buying on margin

The Ayr Bank and the Credit Crisis of 1772

These 2 mistakes are similar to the ones that came from the creation of the Ayr Bank in Britain that led to the 1772 Credit Crisis.

That bank was created in order to grow the economy by lending a lot of paper money* as bank notes, a relatively new invention back then.

- A lot of people really did borrow, to the point that the bank went out of business by 1772.

- Ayr Bank was like a unified central and commercial bank that did both wholesale and retail

But unlike the 1929 crash that led to the Depression, the one in 1772 resolved itself naturally, with the Americans leaving Britain.

- This is similar to a potential Grexit as a consequence of the Greek Debt Crisis after 2008.

So what did 1772 do right to avoid the large crisis experienced by 1929?

1772 Had No Profit Maximization

The main difference was that the doctrine of profit maximization did not exist back in 1772. Rather, it was practiced privately but not taught in schools.

It was only formalized in the 1870’s* through the marginal revolution or Marginalism and subsequently taught by Alfred Marshall, a British economist. His work was then carried by Keynes, another British economist, who cites Marshall’s work heavily. We can say that Keynes was a Marginalist too, aside from being anti-classical.

Superphysics Note

The main difference between Keynes and Marshall was, while Marshall valued real productivity as the cause of wealth, Keynes valued money as ’liquidity preference':

The psychological time-preferences of an individual need two sets of decisions.. the “propensity to consume”.. and his liquidity preference: How long does he intend to have his money savings and not spend it? The mistake of previous theories on the rate of interest is to neglect the liquidity preference. This neglect is what we are repairing. The ratio ofthe amount of moneyand the liquidity-preference determines the actual rate of interest in given circumstances.

John Maynard Keynes

The General Theory of the Rate of Interest, Chapter 13

The difference between 1772 and 1929 is that the latter had profit maximization being taught to everyone. This led to a widespread accumulation of money which will only be spent IF there are profits to be made.

The problem is that profits decline through time as the lack in society is reduced. If everyone already has an iPhone, a car, and a house, then there would be no more demand for those things. This would then cause profits to decline – which is supposed to be a good thing.

But because of profit maximization, this becomes a bad thing. Unable to find higher profits naturally, people stop spending and investors stop investing. This stops the natural circulation of money.

With a lot of idle money in the economy, speculators see this as an opportunity to create attractive, profitable scams which lead to bubbles. This explains:

- the 1929 Crash in the US, after many years of the Roaring 20’s

- the Dot Com Bubble and the 2008 Financial Crisis, after many years of economic boom

- the current rise in Bitcoin and crypto-bubbles

Profit Maximization Hijacked QE in the US

The US tried to solve the decline from the 2008 Financial Crisis with QE wholesale money that was supposed to fill retail money.

| Program | Estimated Total Purchase Amount | Assets Purchased | Notes |

|---|---|---|---|

| QE1 Nov 2008 – Mar 2010 | $1.75−$2.1 Trillion | Mortgage-Backed Securities (MBSs), Treasury notes, agency debt | Focus on the housing market through MBS purchases |

| QE2 Nov 2010 – Jun 2011 | $600 Billion | Primarily long-term Treasury securities | For lowering long-term interest rates |

| QE3 Sep 2012 – Oct 2014 | $1.7 Trillion | MBSs ($40B/month) and Treasuries ($45B/month, later increased) |

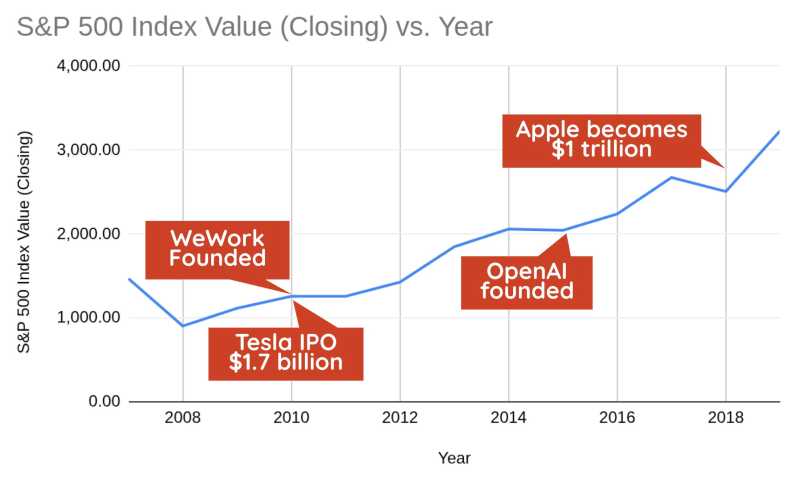

But instead of driving US growth, the wholesale money merely circulated between stock corporations instead of going down to the real economy as employment.

This led to:

- trillion dollar companies

- absurd startup valuations such as WeWork being valued at $47 billion

Classical Economics was Wiser

In the classical system, however, there is no profit maximization. People spend money liberally and accumulation does not become so widespread. Is there a demand for a railroad? Then let’s build one*. Are more steamships needed? Let’s borrow money to engineer one.

Superphysics Note

The question in Classical Economics becomes the credit-worthiness of those who want to get loans to make good investments.

Thus, in the classical system, good investments are not forced. Instead, they are spotted by entrepreneurs and grown naturally through creditors who will give whatever interest rate is natural for that time.

An easy proof is Andrew Carnegie selling his steel company to JP Morgan at a non-profit maximizing price of $480m which was much lower than what JP Morgan was willing to pay. This allowed productivity to march forward naturally, instead of being stopped by the arbitrary gates of the profiteer.

Profit maximization explains why interest rates became so important to the Neoclassical system, but not so much to the Classical one.

The next post will explain how Keynes made interest rates and the financial system (unproductive labor) more important than the workers and entrepreneurs (productive labor) who actually create wealth.