The Great Depression and Profit Maximization

Table of Contents

The industrial revolution in Europe in the 19th century allowed mass production which allowed huge profits for those who invested in them.

- However, the mutual competition among producers reduces the profits that they could gain.

Our current social progress tends to diminish this minimum rate of profit

John Stuart Mill

Principles of Political Economy (1848), Book 4, Chapter 4

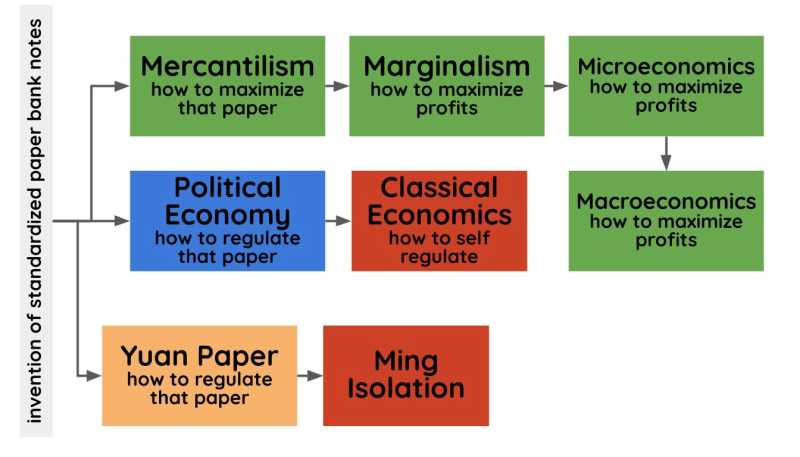

This need to raise profits then led to the concept of profit maximization taught in universities under the Marginal Revolution of the 1870’s.

- Profit maximization is a concept from Mercantilism, which was denounced by the then new science called Political Economy.

The Marginal Revolution, however, enshrined it by creating the new field of microeconomics.

- The Political Economy was then converted into another field called macroeconomics.

Thus:

- Micro and Macroeconomics led to a new science called Neoclassical Economics

- The Political Economy was renamed Classical Economics

*We define profits as revenue from lack

Instead of treating microeconomic profits as a bad thing that sucked wealth into private hands, it was changed into something good. Any bad effects would then be corrected by macroeconomics.

Everyone was then taught to keep on maximizing and increasing private profits.

But the big problem is that high profits are only natural in backward economies:

A country fully stocked in all the trades possible would have great competition everywhere. It would reduce ordinary profits to the minimum.

Adam Smith

Wealth of Nations Book 1, Chapter 5

As a country became developed, profits naturally declined.

The obsession with high profits made investors stop investing in low-profit ventures, focusing only on high-profit ones.

The big problem again is that high-profit ventures in a low-profit environment inherently becomes more risky and speculative as the society progresses.

Thus, the doctrine of profit maximization:

- starved the low-profit parts of the economy (which is now the majority) of its money-lifeblood

- oversupplied the speculative, non-essential parts.

This led to an imbalance which resulted in a crash, followed by a recession which represents the starvation of value.

Under Classical Economics, low prices during a recession would prompt both businesses and consumers to invest and spend to revitalize the economy again.

However, in a Neoclassical profit-maximizing economy, the people still do not invest nor spend, since they have been programmed to go for high returns only.

This makes money static, prolonging the starvation of value, causing the Great Depression of the US in the 1930s.

The Wrong Solutions of Keynes

The simplest solution was to remove profit maximization from the minds and hearts of people.

- This would make people invest in productive companies (not loss-making) regardless of size

- Those companies would then hire workers

- Those workers would then revive the economy by spending their wages

But instead of throwing away profit maximization, the British economist John Maynard Keynes proposed 2 solutions:

- Deficit spending

- Open-market operations

These are now part of macroeconomics.

1. Deficit Spending

Deficit spending is a fiscal solution wherein the government spurs the economy by doing the spending and investment.

- This now manifests as big public works projects.

This then jumpstarts the economy through ‘multiplier effects’:

It follows that if the people choose to consume, then the multiplier k is 10, and the total employment caused by increased public works, for example, will be 10 times the primary employment provided by the public works themselves

John Maynard Keynes

The General Theory Simplified, Chapter 10

The government gets the spending-money by borrowing from private people through bonds.

This unlocks the money made static by profit maximization. The fact that this plan worked proves that, in the Negative Force, the instinct for self-preservation is superior to the desire for luxuries.

A big decline in income due to a decline in the level of employment may even cause consumption to exceed income. In the case of the Government, it will run into a budget deficit by providing unemployment relief by borrowing money.

John Maynard Keynes

The General Theory Simplified, Chapter 8

The fact that this plan worked proves that, in the Negative Force, the instinct for self-preservation is superior

2. Open-market operations

Deficit spending sucks idle money from profit-maximizing people and puts it back to work in the economy thourgh large government projects.

- Those projects give money to employees.

- Those employees then spend that money to buy things.

- Those things would bring emplyoment to people instead of keeping them idle

However, this dynamic flow of money might be too slow to spread throughout the economy.

Open-market operations, as a monetary solution, speeds this up by selling back the money that governments got from issuing bonds.

- This now manifests as quantitative easing.

The aggregate demand for money to satisfy the speculative-motive continually responds to changes in the rate of interest, as a curve. These changes are in the changing prices of bonds and debts of various maturities. This is why “open market operations” are done… Open-market operations may influence the interest rate since they may change the volume of money and change expectations on the future policy of the Central Bank or the Government.

John Maynard Keynes

The General Theory Simplified, Chapter 15

The Flaws of Both Solutions

Deficit spending leads to budget deficits which would then need to filled by loans.

- Such loans employ the banking system

- The problem is that the banking system is unproductive labor

Moreover, excessive budget deficits lead to government shutdowns and increase the tax burden of people

Open-market operations, on the other hand, forces idle money into speculation namely:

- stock buybacks

- tech startups

- rise of housing prices

- privatization

The speculation leads to inflation, such as property bubbles and spikes in commodity prices. Keynesians then solve inflation by raising interest rates which then cause a recession – a lose-lose situation!

These defeat the goals of sustainable economic growth. Accordingly, the quantitative easing from 2008 in the United States led to many imbalances from 2015-2019 until everything came apart in 2020 during the pandemic.

So both solutions do not strike at the root cause. Instead, they merely replaced a quick decline with a slow one, stretched over many years.

- The decline from the 1929 crash was slowed down until the great collapse from WWII from the 1940s

- The decline from the 2008 crash was slowed down until the great collapse from the 2020 Pandemic and subsequent shrinkflation

The Supereconomics Solution to the Great Depression: Essential Barter and Deficit Investment

The easiest solution in the paradigm of Classical Economics is to get rid of profit maximization.

Supereconomics replaces it with minimum needs.

During the transition from Neoclassical Economics to Supereconomics, the following steps can be taken to transition to a minimum needs system:

- Implement a barter system of credit in order to maintain the essential parts of the economy.

This is opposed to monetary solutions and will prevent inflation and the cannibalization of the economy. This works on circulating capital.

- The government raises bonds to acquire failing companies that are essential to the economy

A collapse of an essential corporation, such as those in utilities and public transportation, would lead to a domino effect.

The government should intervene by buying those companies at a discount and then propping them up with taxpayer money.

When the economy recovers, they can sell some of the shares back to the market.

This is opposed to deficit spending, since it will be “deficit investment” and works on fixed capital.